Coupay - Smart Invoicing

& Payment Platform

Streamlining Payments for SMEs & Freelancers with Open Banking

Our client, Coupay, is a growing fintech startup that set out to change how small businesses, freelancers, and self-employed professionals handle payments. Their goal was to make invoicing simpler and speed up bank transfers. By using Open Banking technology, they built a secure, easy-to-use platform.

Coupay wanted to solve the common problems of high costs and inefficiencies in traditional payment methods, giving users a better way to manage their finances with confidence and convenience.

What Was the Challenge?

Before Coupay, small businesses, freelancers, and self-employed professionals faced several challenges with payments:

Delayed Payments: Managing invoices and chasing clients for timely payments was a time-consuming and frustrating process.

High Transaction Fees: Traditional payment solutions charged steep fees, cutting into already tight profit margins.

Limited Access to Simple Solutions: Existing tools were often complicated, costly, or lacked features tailored to SMEs and freelancers.

Cash Flow Struggles: Payment delays and disorganized invoicing made it hard for users to maintain steady cash flow, affecting their financial stability.

Our Solution

We developed a robust and scalable fintech platform designed to cater to the unique needs of SMEs and freelancers. The smart invoices enable customers to make secure and convenient payments through bank transfers with just a few taps on their mobile phones. All they need is their normal bank account!

Smart Invoicing

Enabled users to create invoices with a “Pay Now” button, directing clients to mobile banking apps for secure payments.

Low-Cost Transactions

Enabled users to create invoices with a “Pay Now” button, directing clients to mobile banking apps for secure payments.

Seamless Bank Integration

Integrated with all major UK banks, providing real-time interoperability and secure payment handling.

Data Security

Implemented industry-standard encryption and secure authentication protocols to protect user data.

Scalability and Accessibility

Designed the platform to cater to businesses of all sizes, ensuring functionality across diverse user bases.

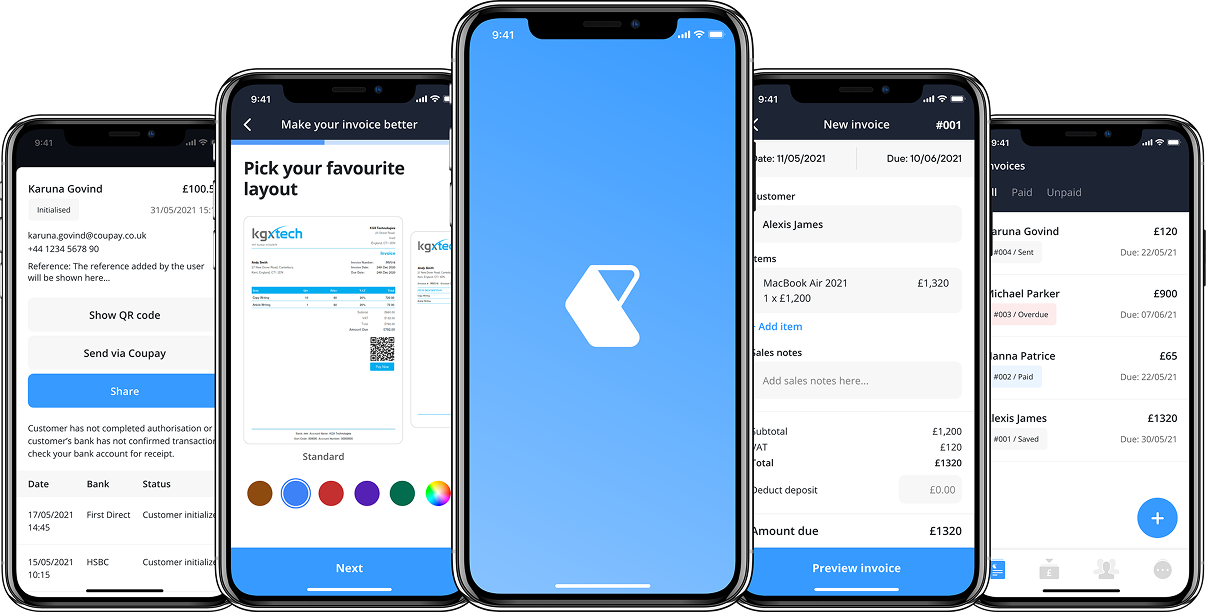

Interfaces We Developed

Invoice Generator

Simplified the creation of tailored invoices with integrated payment options.

Payment Dashboard

Allowed users to track payments, overdue invoices, and client activity.

Notification System

Sent reminders for due and overdue payments, minimizing delays.

Bank API Management

Coordinated seamless integration with UK banks, ensuring smooth operations.

User Analytics

Tracked engagement, payment trends, and operational metrics to enhance user experience.

Compliance Tools

Monitored adherence to financial regulations and ensured data integrity.

How Does It Work?

Invoice Creation

Users generate a Smart Invoice through the platform, incorporating the “Pay Now” feature.

Payment Initiation

Clients receive the invoice and are directed to mobile banking apps, where payment details are prefilled.

Real-Time Updates

Users receive notifications on payment status, including successful transactions and overdue alerts.

Secure Data Handling

All transactions are protected with encryption, ensuring a secure payment environment.

Outcomes & Impact

Trusted by SMEs & Freelancers

Coupay has become a go-to solution for numerous businesses & individuals seeking streamlined invoicing and payment processes.

£200k Secured in Pre-Seed

Successfully raised funds in a pre-seed round led by SFC Capital, validating its innovative approach and market potential.

Integration with Major UK Banks

Seamlessly integrated with all leading UK banks, ensuring compatibility and widespread accessibility for users.

Technologies Used to Develop the Solution

Frontend

React.js

Built responsive, user-friendly interfaces for web users.

Flutter

Developed a cross-platform mobile app for Android and iOS.

Backend

Node.js

Handled API requests and server-side logic.

GraphQL

Enabled efficient querying for seamless data retrieval.

APIs and Integrations

Plaid API

Aggregated bank account data securely.

Open Banking API

Connected to UK financial institutions for real-time payment handling.

Database

PostgreSQL

Stored invoice and transaction data securely.

Redis

Managed high-speed caching for real-time notifications.

Security

TLS/SSL Encryption

Secured data transmission.

OAuth 2.0

Implemented secure authentication for users.

DevOps

AWS

Hosted the platform for scalable operations.

Docker

Standardized deployments for reliability across environments.

Here’s what the client has to say!

Building Coupay was an ambitious journey, and this team brought our vision to life with incredible precision. They understood the challenges freelancers and SMEs face and created a platform that not only simplifies invoicing but also integrates seamlessly with trusted UK banks.

The feedback we’ve received from early adopters has been amazing. We’re confident this will make a real difference for businesses handling payments daily.